interest tax shield example

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. When John files his tax return for the year 2011 he qualifies for a 1000 child tax credit which lowers his tax bill by 1000.

The Interest Tax Shield Explained On One Page Marco Houweling

In contrast though with the Interest Tax Shield it is Interest Expense that shields a Company from taxes paid.

. Therefore XYZ Ltd enjoyed a Tax shield of 12000 during FY2018. Interest tax shields refer to the reduction in the tax liability due to the interest expenses. Depreciation tax shield 30 x 50000 15000.

For example if you expect interest on a mortgage to be 1200 for the year and your tax rate is 20 the amount of the tax shield would be 240. Uses Relevance The Tax Shield approach minimizes the tax bills for the taxpayer. For example there are some cases where mortgages have an interest tax shield for the buyers as the mortgage interest is deductible on the income.

Companies pay taxes on the income they generate. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. That is the interest.

A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. The interest that one.

Tax shields do not only benefit the wealthy however. Is considering a proposal to acquire a machine costing 110000 payable 10000 down and balance payable in 10 equal installments at the end of each year inclusive of interest chargeable at 15. That is the interest expense paid by a company can be subject to tax deductions.

Interest Tax Shield Calculation Example ABC Ltd. The tax shield in this case will be 4000 10 200000 20. A companys interest payments are tax deductible.

There are hundreds of different tax shields available to individuals and companies though the tax shields. To learn more launch our free accounting and finance courses. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax shield approach will be worth 200.

Tax shields differ between countries and are based on what deductions are eligible versus ineligible. Prior period adjustment definition. Use these articles to find and calculate the corporate tax rate and individual tax rates for the current year.

The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. And a 35 tax rate. Let us take the example of another company PQR Ltd which is planning to purchase equipment worth 30000 payable in 3 equal yearly installments and the interest is chargeable.

The tax savings for the company is the amount of interest multiplied by the tax rate. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt Cost of Debt The cost of debt is the return that a company provides to its debtholders and creditors. The classic example of a tax shield strategy for an individual is to acquire a home with a mortgage.

Interest expenses via loans and mortgages are tax-deductible meaning they lower the taxable income. For example if a company has cash inflows of USD 20 million cash outflows of USD 12 million its net cash flows before taxation work out to USD 8 million. This companys tax savings is equivalent to the interest.

An interest tax shield may encourage a company to finance a project through debt. The Interest Tax Shield concept is highly relevant for Leveraged Buyout LBO acquisitions executed by Private Equity firms. Another option before it is to acquire the asset on a lease rental of 25000 per annum payable.

For example lets say John and his wife have a baby in 2011. Interest in student loans also works as a tax shield. Basically the company uses two main tax shield strategies.

Tax Shield Deduction x Tax Rate. Such a deductibility in tax is known as interest tax shield. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m.

Interest Tax Shield Example. A company carries a debt balance of 8000000 with a 10 cost of debt Cost of Debt The cost of debt is the return that a company provides to its debtholders and creditors. For example a mortgage provides an interest tax shield for a property buyer because interest on mortgages is generally deductible.

Businesses as well as individuals may choose to utilize this type of shield as a means of choosing how to finance different purchases and projects simply to maximize the amount of. For example Company ABC has a 10 loan of 200000 and the applicable tax rate is 20. The impact of adding removing a tax shield is highly impacted by the companys optimal capital structure which is a mix of debt and equity fundingMoreover the interest expense on the debt is tax deductible which makes the.

Sales budget Sales. The Interest Tax Shield is the same as the Depreciation Tax Shield in concept. A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

Interest Tax Shield Interest Expense Tax Rate. In other words Johns baby is a tax shield. This is usually the deduction multiplied by the tax rate.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. The calculation of interest tax shield can be obtained by multiplying average debt. Interest Tax Shield Example.

If the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Many middle-class homeowners opt to deduct their mortgage expenses thus shielding some of their income from taxesAnother example is a business may decide to take on a mortgage of a building rather than lease the space because mortgage interest is deductible thus serving as a tax shield. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

The effect of a tax shield can be determined using a formula. This tax shield example template shows how interest tax shield and depreciated tax shield are calculated. January 13 2022 Steven Bragg Taxation.

Thus interest expenses act as a shield against tax obligations. Cost of debt is used in WACC calculations for valuation analysis.

Tax Shield Formula Step By Step Calculation With Examples

The Effect Of Gearing Week Ppt Video Online Download

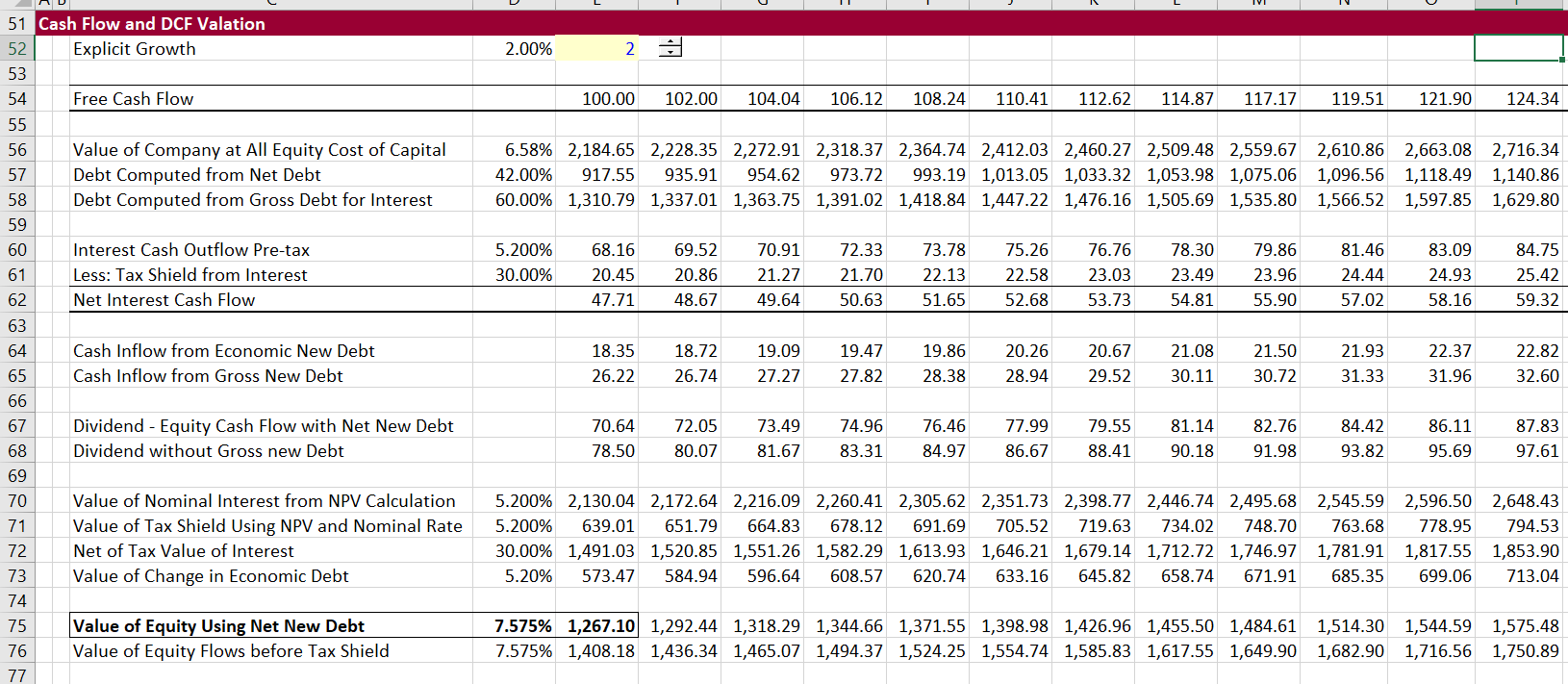

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

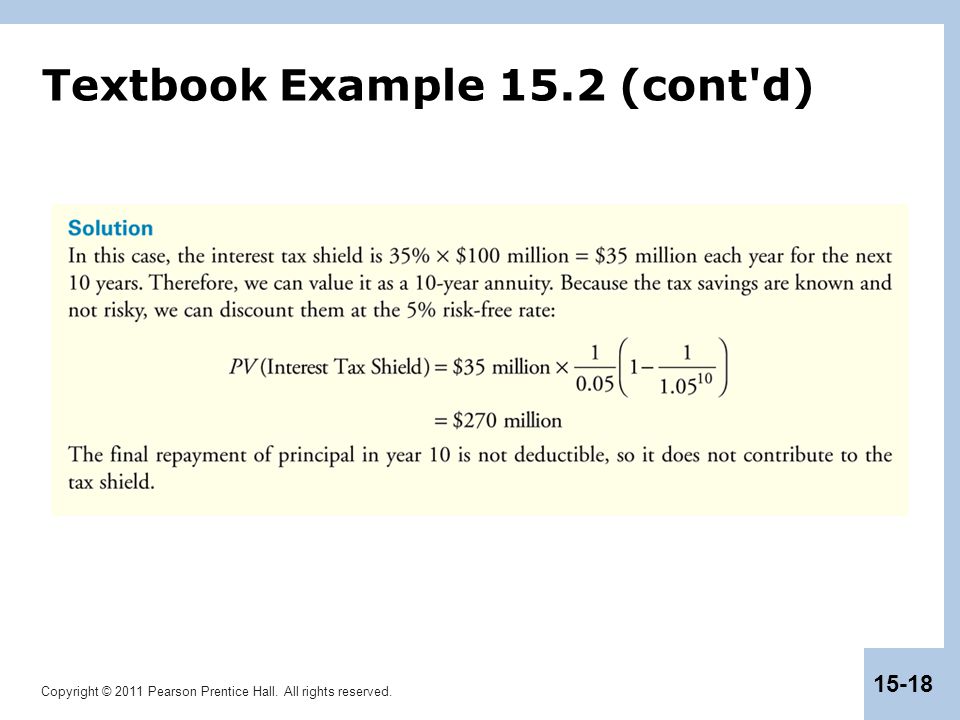

Chapter 15 Debt And Taxes Ppt Download

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Interest Tax Shield Formula And Excel Calculator

Interest Tax Shields Meaning Importance And More

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples