sales tax calculator buffalo ny

Ad Automate Standardize Taxability on Sales and Purchase Transactions. For State Use and Local Taxes use State and Local Sales Tax Calculator.

With local taxes the total sales tax rate is between 4000 and 8875.

. New York NY Sales Tax Rates by City A The state sales tax rate in New York is 4000. Usually the vendor collects the sales tax from the consumer as the consumer makes a. NYS Petroleum Business Tax.

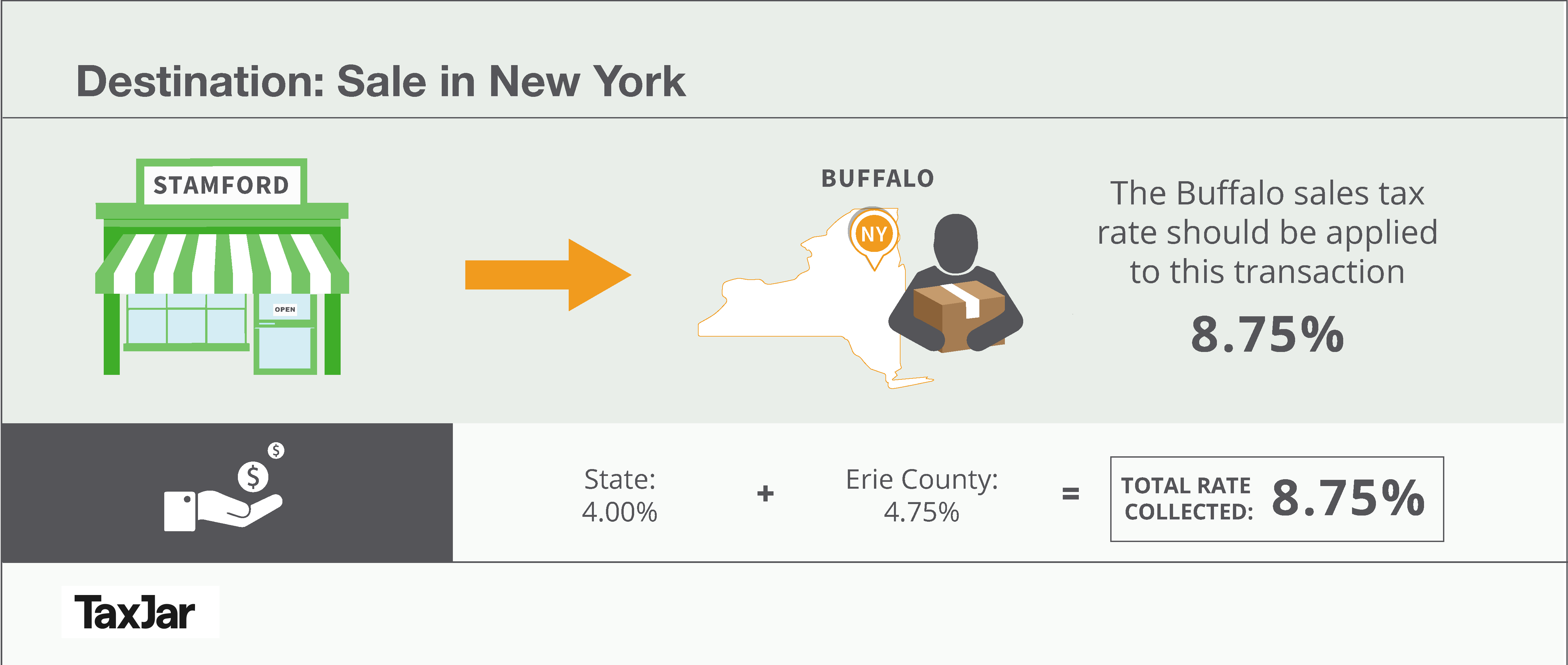

An additional sales tax rate of. The Erie County New York sales tax is 875 consisting of 400 New York state sales tax and 475 Erie County local sales taxesThe local sales tax consists of a 475 county sales tax. The New York sales tax rate is currently.

Calculate a simple single sales tax and a total based on the entered tax percentage. Collect and remit the proper amount of tax due. Erie County Tax NYS Petroleum Testing Fee.

You could be subject to sales and use tax penalties if you fail to. However all counties collect additional surcharges on top of that 4 rate. NY Sales Tax Rate.

Sales and use tax. Integrate Vertex seamlessly to the systems you already use. Use tax applies if you buy tangible personal property and services.

New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. Overview of New York Taxes.

New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Federal Tax 0184. This means that depending on where you are.

0125 lower than the maximum sales tax in NY. There is no applicable city tax or. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all.

File sales and use tax returns on time. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The December 2020 total local sales tax rate was also 8750.

Sales Tax State Local Sales Tax on Food. Just enter the five-digit zip. The minimum combined 2022 sales tax rate for Buffalo New York is.

Real property tax on median home. Register to collect tax. Sales Tax State Local Sales Tax on Food.

Sales Tax State Local Sales Tax on Food. Real property tax on median home. Real property tax on median home.

The current total local sales tax rate in Buffalo NY is 8750. Integrate Vertex seamlessly to the systems you already use. NYS Taxes 0342.

Sales Tax State Local Sales Tax on Food. Sales tax applies to retail sales of certain tangible personal property and services. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Real property tax on median home. At 4 New Yorks sales tax rate is one of the highest in the country. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Buffalo NY.

This is the total of state county and city sales tax rates. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax.

.png)

States Sales Taxes On Software Tax Foundation

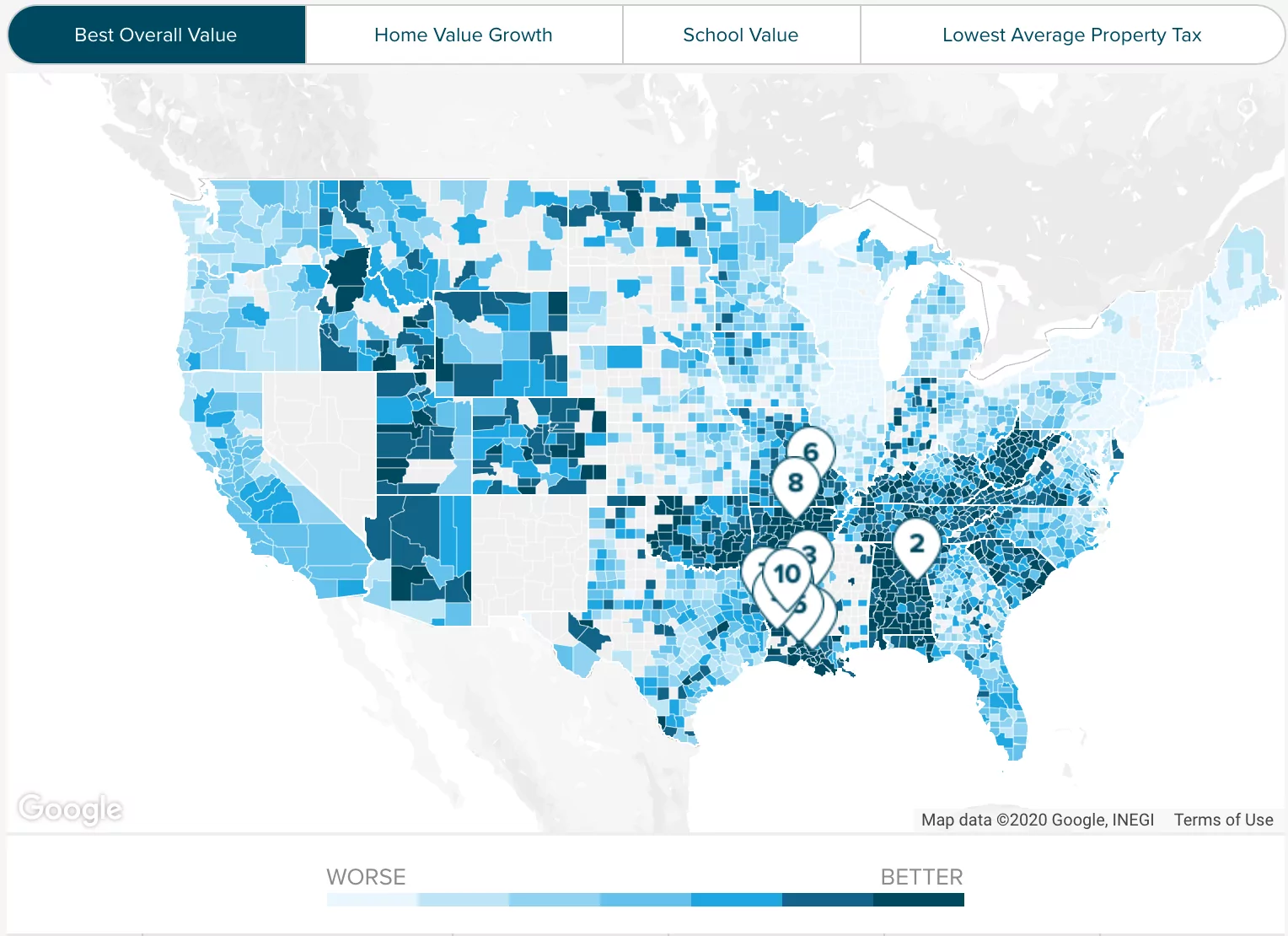

New York Property Tax Calculator Smartasset

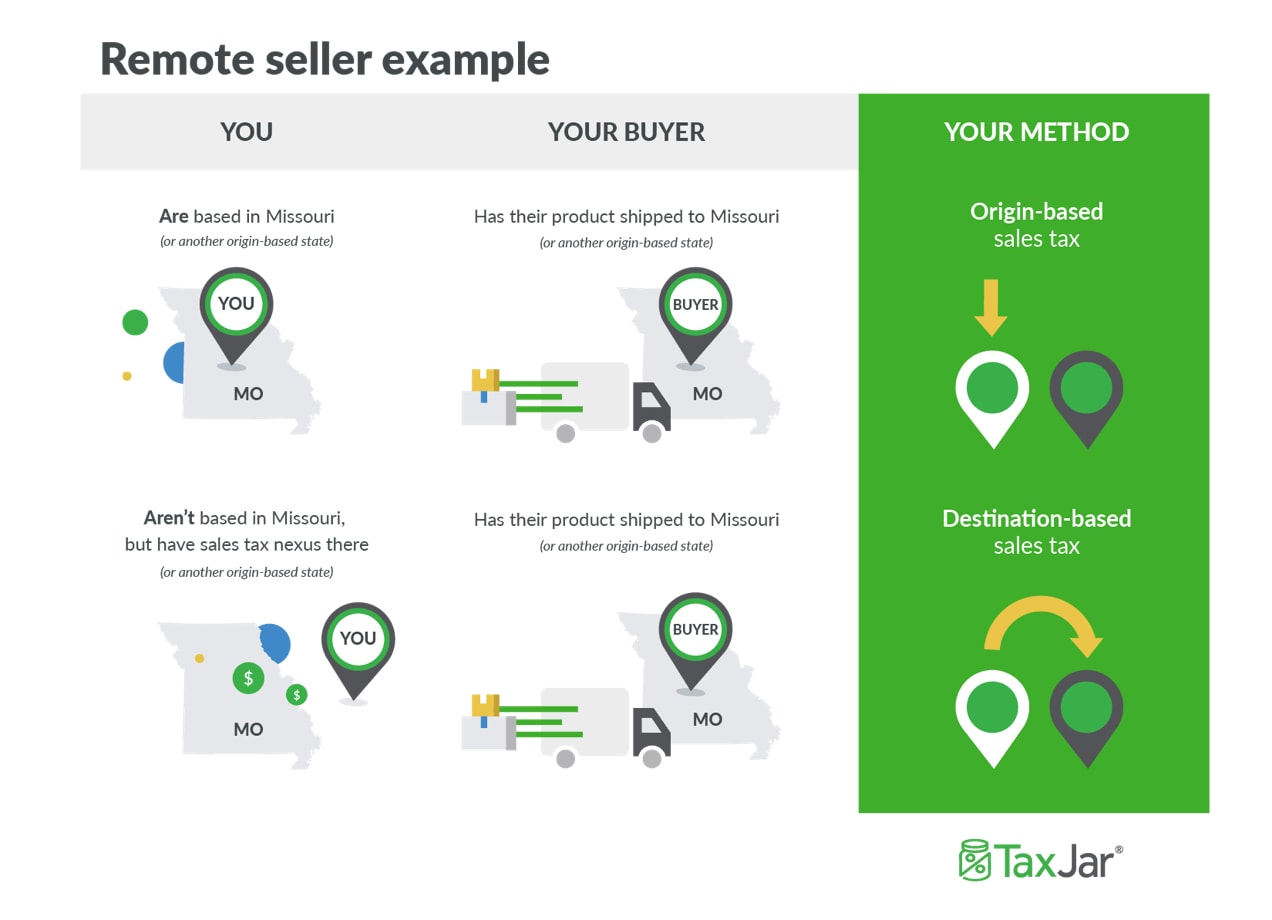

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

State Income Tax Rates And Brackets 2022 Tax Foundation

Wisconsin Property Tax Calculator Smartasset

Hennepin County Mn Property Tax Calculator Smartasset

How To Charge Your Customers The Correct Sales Tax Rates

New York Sales Tax Rates By City County 2022

Sales Order Template 2 Order Form Template Order Form Template Free Word Template

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Is Saas Taxable In New York Taxjar

New York Property Tax Calculator 2020 Empire Center For Public Policy

Online Sales Tax Compliance Ecommerce Guide For 2022

Minnesota Sales Tax Calculator Reverse Sales Dremployee

![]()

Property Tax Jefferson County Tax Office

New York Sales Tax Guide And Calculator 2022 Taxjar

How To Charge Your Customers The Correct Sales Tax Rates